Follow us on social media:

China has launched the second phase of its pilot test programme for its central bank digital currency (CBDC). It is a first in China that the city of Guangzhou accepts the digital yuan (e-CNY) CBDC for bus fare on 10 different transit routes. Passengers can pay for their bus ride by downloading the e-Chinese New Year (CNY) app, making a deposit, and scanning a QR code in the bus’s payment section.

This year, the Chinese government has quickly made the e-CNY app more useful. As of last week, CBDC could be used to pay into Guangzhou’s employee housing fund. In order to encourage consumer spending despite severe coronavirus lockdowns, the government collaborated with the food-delivery giant Meituan and the e-commerce platform JD.com to disburse e-CNY air-drops redeemable at specific businesses.

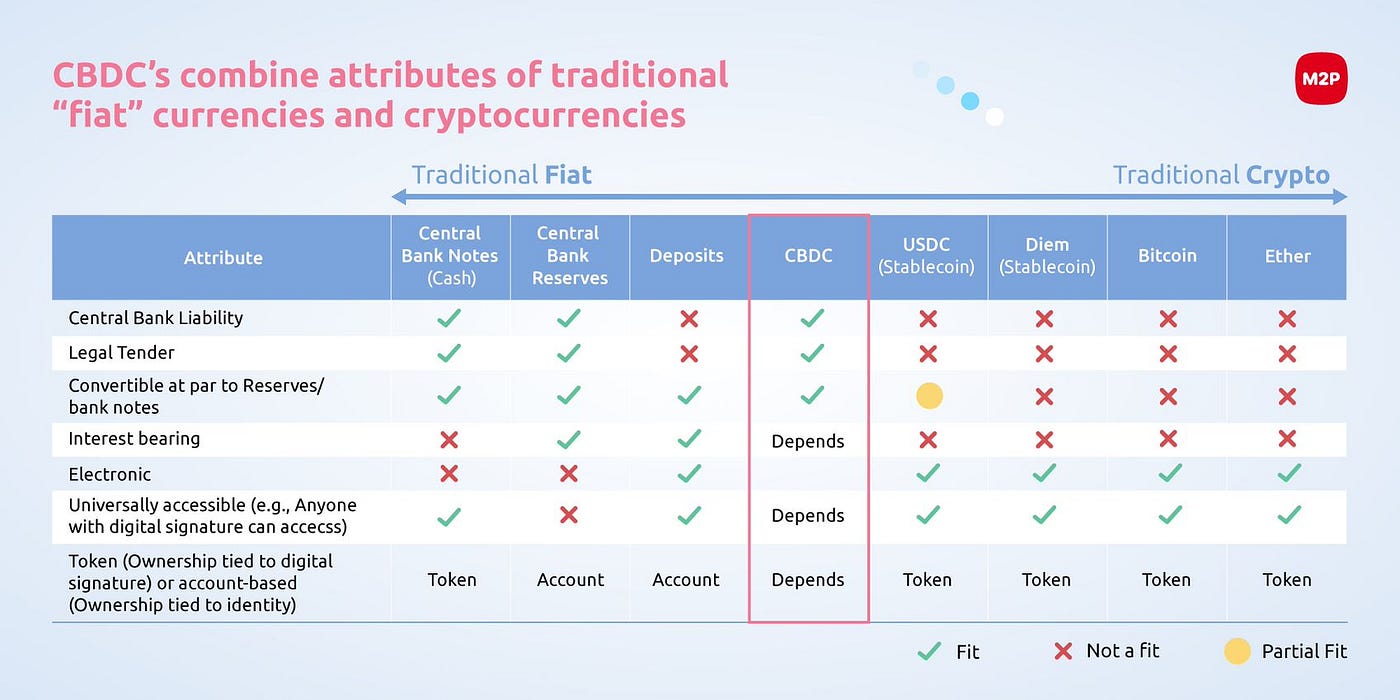

Similarly, other central banks all over the world are thinking more and more about making their own CBDCs to give institutions and consumers privacy, ease of use, accessibility, and financial security. Like physical money, CBDCs are expected to be legal tender with a value that can be kept on central ledgers run by the national bank. CBDCs are safer and less volatile than other digital currencies because of this process.

CBDCs are extremely adaptable and flexible. They provide central banks and governments the freedom to analyse and build CBDC models to meet their needs.

Singapore built a payment system that sped up and reduced the cost of cross-border transactions and currency conversion. England may enable people to use digital currencies in addition to cash and bank deposits.

CBDCs has a huge amount of potential to make financial services cheaper, easier to get, and faster.

The retail CBDC model would assist underbanked or unbanked nations become more inclusive. Avoid dangerous trades by putting money in central banks.